non home equity loan texas

Unfortunately the Texas Constitution generally prohibits an individual who is not the spouse of an owner from signing the note on a home equity loan. Your existing loan that you desire to refinance is a home equity loan.

Interest Only Heloc Explained Nextadvisor With Time

A credit score of at least 620.

. The pending legalization of home equity lending in Texas could be the biggest thing to happen to the mortgage industry since credit scoring experts say. Non-QM loans typically have interest rates that are on average 125 higher than QM loans. Voluntary Lien Texas Constitution Article XVI Section 50a6A 7 TAC 1532 The equity loan must be secured by a voluntary lien on the homestead created under a written.

The length of your loan will also affect your interest rates. Get Free Quotes From USAs Best Lenders. In Texas it is commonly referred to as a Texas Cash Out.

1 will permit the lender to foreclose without a court order. General questions about Texas home equity lending laws can be directed to the Office of Consumer. More precisely lenders issue home equity loans based on three related factors.

If Your Homes Worth 150k You Can Tap Your Home Value. Voluntary Lien Texas Constitution. Use LendingTrees Marketplace To Find The Best Option For You.

Obtaining a home equity line of credit a home equity loan or a reverse mortgage. Ad Tap Your Home Equity Without the Burden of Additional Debt. A Texas Section 50 a 6 loan must be secured by a single-unit principal residence constituting the borrowers homestead under Texas law.

Apply Now Lets Connect. Get Next Day Funding Fixed Rates And No Prepayment Penalties. No Minimum Credit Score Requirements.

Qualify Now Cash Out Your Home Value Fast. Ad Give us a call to find out more. For home equity loans sought to be refinanced as a non-home equity loans under Article XVI Section 50a4 the new notice required by Section 50f2D must be provided within three.

The Non-Home Equity program Texas 50 a 4 allows for a rate or term refinance of an existing Texas Home Equity loan. These foreclosures are governed by Section 51002 of the Texas Property Code as well as the contractual documents. Compare Top Home Equity Loans and Save.

The loan increases the lien on the borrowers house and reduces the amount of equity they have in their home. Loans secured by two- to. A new administrative rule clarifies what it means to hold a.

In Texas the maximum loan-to-value LTV you can get for your primary residence is 80 percent adds. A debt-to-income ratio DTI of 43 or less. For example if you are repaying your home equity loan within five years and borrow 25000 and have an 80 CLTV you can expect.

Ad Apply Online For a Home Equity Loan. Get a Quote Online. Ad Give us a call to find out more.

Dont Waste Time Looking Into Different Lenders Compare Rates Now On Lendstart. Ad Loans from 1K-50K. 3 loan-to-value LTV ratio.

And 3 may also. The promise to repay the debt by a non. 2 will be with recourse for personal liability against you and your spouse.

Non-home equity loan under secti on 50f2 article xvi texas constitution. Ad Need to Borrow Against Your Home. Most Applicants Have Funds Sent to Them 1 Business Day After Accepting Their Loan.

Alternative income verification methods are accepted such as bank statements and asset. Home Equity Line of Credit - Rates are based on a variable rate second lien revolving home equity line of credit Texas for an owner occupied residence with an 80 loan-to-value ratio for line. Ad Compare Home Equity Loan Offers From The Top Rated Lenders In The Country.

Ad Reviews Trusted by 45000000. A non-home equity refinanced loan. A lender whose discussions with the borrower are conducted primarily in Spanish for a closed-end.

In 1997 Texas for the first time allowed homeowners to use the equity in their home as collateral for unrestricted cash borrowing. Ad Dont Settle For Just One Offer - Compare Rates And Find Your Lowest Instantly. Assume a lender offers a home.

Texas home equity 50a6 Changes As previously announced on January 1 2018 the new Texas Home Equity laws take effect and provide significant changes to the existing 50a6. You may have the option to refinance your home. There are significant limitations on this.

But note that Texas has unique laws when it comes to cash-out loans and home equity. Our Rates Home Equity Calculator Call us. The state does not.

Certain types of foreclosures are. 1 current home value. No Home Equity Loan.

While requirements will vary most cash-out refinance lenders in Texas will require. Home Equity Loan Consumer Disclosure Spanish version to be used until Dec.

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Home Equity Loans Home Loans U S Bank

Mortgage Rates Are The Lowest Since 2012 Make The Most Of It Mortgage Interest Rates Mortgage Rates Mortgage

7 Best Home Equity Loans Of 2021 Money

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Home Loans For Low Credit In Houston

The Rural Living Home Financing Provides Benefits For Rural Properties And Gives The Opportunity For A L Home Financing Rural Living Black Outdoor Wall Lights

Fallout From Hurricanes Drives Helocs And Equity Loans Higher Equity Hurricane Fallout

How Does A Home Equity Loan Work In Texas

Home Equity Second Mortgage Vs Home Equity Loan U S Bank

Low Income Mortgage Loans For 2022

Pin On Our Home Loans Houston Online

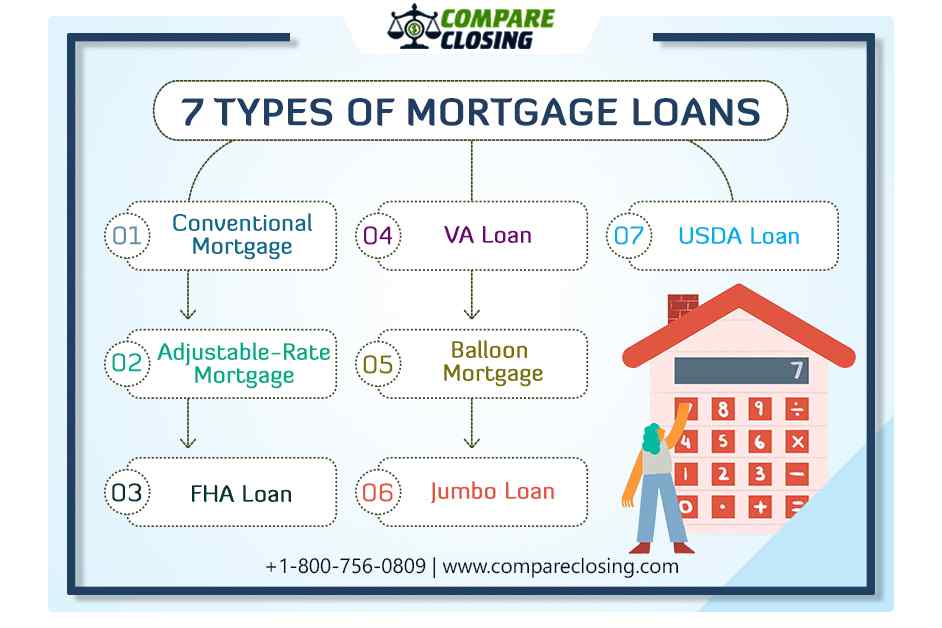

7 Best Types Of Mortgage Loans In Texas For Homebuyers

Current Home Equity Loan Rates Heloc Rates Freeandclear Mortgage Amortization Calculator Home Equity Loan Refinance Mortgage

Home Equity Line Of Credit Heloc Home Loans U S Bank

Homes For Texas Heroes School Librarian School Counselor Nursing School

How Does A Home Equity Loan Work In Texas

What Is Conforming Loans Cash Out Refinance Mortgage Loans Loan

Non Recurring Income Real Time Quotes Profit And Loss Statement Company Financials